New Shopper Experience Study

A diary study examining the new shopper experience on Facebook Marketplace using desktop.

Context

Organization

The Facebook Marketplace Growth team wanted to understand the new shopper experience on Facebook Marketplace desktop. While previous research had focused on the mobile experience, no studies had yet been undertaken specifically to understand the desktop experience for new shoppers (particularly since the introduction of shippable listings and other new features). The team was curious about users’ first impressions, as well as which factors made it easier vs. harder to discover and consider items for sale on Marketplace. By making a better early impressions, the team reasoned that new shoppers would be more likely to re-visit and eventually purchase through the platform.

Goals

Business goal: Convert new users through the shopper funnel, from discovery to purchase.

Research goals: Uncover shoppers’ first impressions of Marketplace on desktop, and barriers and facilitators to item discovery and consideration.

Team

My role: Research lead

Stakeholders: Engineering lead, design partner

Study Design

Method

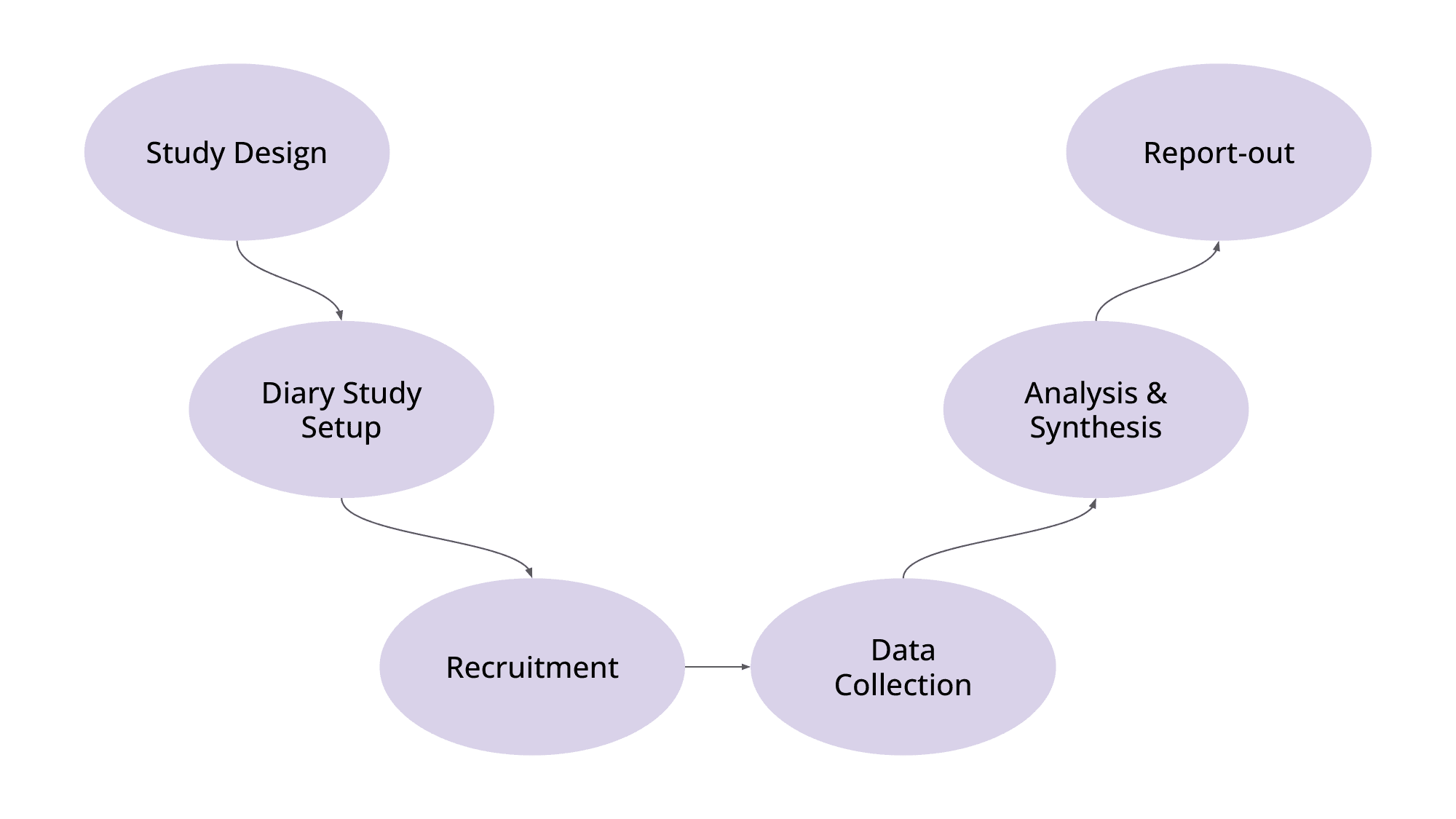

To understand users’ first impressions and reactions to the product, I wanted to learn from users as they actually interacted with the product for the first time - using their own devices, in their own contexts. For this, I decided to use a diary study, which would allow me to follow users along in their experiences for nine days with interacting with Marketplace.

Sample

30 people who shopped online. Two thirds had never interacted with Marketplace before; inadvertently, one third had visited Marketplace. I kept these latter users in the sample, and during analysis checked to see if themes differed based on prior Marketplace experience.

Tools

Dscout, Google Suite

Process

I structured the diary study into a series of tasks over several days. This allowed me to capture both initial (first) impressions, as well as impressions after several visits. I collected a variety of data types, from video recordings as participants narrated their visit, to follow-up questions. I ended the study with a love/breakup letter exercise, to capture powerful artifacts describing why participants loved Marketplace (and planned to return) or disliked the platform and planned to leave.

Key Insights

First Impressions

Quality, inventory, and prices shaped initial impressions of Marketplace.

Item quality made a lasting first impression. Some shoppers were discouraged by the low quality of listings shown in their Marketplace feed, especially if they preferred new items. Conversely, seeing a wide variety of inventory and low prices made positive impressions. (Note that for prices that seemed unusually low, in particular for expensive electronics, shoppers raised concerns about scams.)

Disorganized and chaotic feeds, as well as the predominance of vehicle and housing rentals, contributed to a sense of overwhelm and confusion.

Often, shoppers opened a Marketplace feed that was dominated by vehicle listings and housing rentals - which fell outside of their expectations and intentions for shopping for goods on Marketplace. This confused them and made it more challenging to find items they were actually interested in (e.g., clothes, electronics, home goods, etc.). Importantly, this insight brought fresh evidence of a broader issue that had been observed in past research.

Similarly, at times the feed felt disorganized and overwhelming, with highly dissimilar items placed in close proximity to one another and no discernible organization.

Product Dicovery

Positive experiences were shaped by helpful product photos and listing categories.

It was easier for shoppers to discover items that interested them when listings included clear photos and were organized into useful categories. Serendipitous discovery even occurred when shoppers discovered items they didn't realize they were looking for. New shoppers were also pleasantly struck by the breadth and value of Marketplace offerings.

"I didn't even search for Angel Sanctuary directly, but it was the perfect thing to have come up with the first item."

"It's easy to navigate… I like how it already broke it down into categories, because it made it a little bit easier for me."

Key barriers to discovering items of interest were a lack of search filters, insufficient inventory, irrelevant items, and misleading prices.

Taken together, these issues made it more difficult for shoppers to find items that interested them. For example, a common missing search filter for clothing and accessories was size. Irrelevant search results and items in category listings also violated shoppers' expectations and increased frustration and time spent. Sometimes, there just weren't enough search results.

These issues were nuanced. For example, "relevance" fell into two types: logical relevance (i.e., matching search terms or categories) and personal relevance (i.e., matching personal preference). Similarly, inventory issues fell into two categories: quantity (i.e., no or few listings to choose from) and quality (e.g., only heavily-used, poor-quality items available).

A further source of frustration was misleading prices. This, too, appeared in multiple ways. For example, at times the stated price of the listing in the feed was less than the actual price, as stated in the listing description. This caused confusion and raised concerns about trust and scams. Another variation of this issue related to holistic price (i.e., price being the whole sum of all related costs). For shipped listings, a shipping fee was often required, but was not included in the total price listed in the feed. Shoppers would discover later, after clicking on an item that piqued their interest, that shipping was not free and could entail substantial cost.

"A lot of the shoe items they showed me were not in my size, so I spent a lot of time looking through various postings just to get to my size. If I was able to filter it to show me within a just my size, it would save time and make finding a product that much easier."

"Initially when I first saw the website, the words 'Free' and '$1' caught my eye. I'm smart enough to know there's a catch, but still these are misleading. When I found the Dewalt drill set I was interested in, it said $1... I knew it wasn't gonna be a dollar so I asked. Turns out it's $1800."

Consideration

Making a purchase decision entailed answering four key questions related to the item, the price, the seller, and the fulfillment method (i.e., local pick-up vs. shipping).

Shoppers needed to know:

Is this the right item for me?

Is this the best deal I can get?

Do I trust this seller (and platform)?

Can I get this item the way I want to?

Barriers to answering any of these questions (see below) made it difficult for shoppers to make a decision about whether or not to purchase an item.

Low quality listings made it difficult to assess whether the item was a good fit.

Shoppers decided whether an item was right for them or not based on elements like photos and descriptions. However, listings often did not have enough photos, or had poor-quality images (e.g., missing angles, blurry resolution, etc.). Similarly, there was often an inconsistent level of detail in descriptions across listings, making it hard to compare items. As a result, shoppers would message sellers to learn more, extending the length of the consideration phase of the journey.

"There were lots of different choices of the type of headphone I was looking for. When I clicked on to get more information, some of them had a lot of information, some of them had very limited information, so it was a little frustrating because I had to keep going through several pairs of headphones to try to sort out what were the ones that I was interested in, what wasn't I interested in."

Shoppers viewed price holistically (e.g., including shipping cost, for shipped items).

As mentioned above, shoppers saw price holistically. Finding the best price for an item entailed doing research both within Marketplace (i.e., comparing items) and outside Marketplace (i.e., looking at other platforms). This was a highly manual process.

"Before I decide to actually go ahead and make the purchase, I would like to look at other similar items on other websites, just to make sure that I'm getting the best price. So that includes eBay and Amazon as well as the Walmart site and the Target site."

"I would go and check more through Facebook Marketplace to make sure that this was in fact the best price."

Lack of seller ratings and reviews, unclear purchase protection policies, and concerns about data privacy and security made it harder for shoppers to trust buying on Marketplace.

Trust was multi-faceted and centered on trust in 1) sellers and 2) the platform. The lack of seller ratings and reviews from past buyers (or other seller verification features) made it difficult for shoppers to assess whether a given seller was trustworthy or not. In this case, "trust" was about whether an item would be as described and that the transaction would be honest and fair.

Trust was also about the platform. Marketplace's lack of parity in purchase protection policies with other platforms made shoppers more hesitant to purchase. In addition, a few shoppers were concerned about the privacy and security of sensitive information (e.g., address, financial information).

"My only critique on this is that verified images should be a thing. I don't think it has to be strict, but for us shoppers, it would make life so much less stressful when shopping outside big retailers… [Sellers] should be able to take pictures through the app which would give each picture taken a verified checkmark to suggest that the seller has the product on hand. That would definitely boost my likelihood of purchasing anything from the website… The less unsettled my mind is about something, the more likely I am to go along with it."

Shoppers saw Marketplace as a place to find items nearby, but often saw listings that fell outside their specified location radius.

The bigger problem was that shoppers often did not realize right away that they were seeing items outside their location radius - leading to wasted time spent on listings that were in fact too far away from them. Importantly, while shoppers saw shipping as a perk, their mental model for Marketplace was primarily as a place for local shopping.

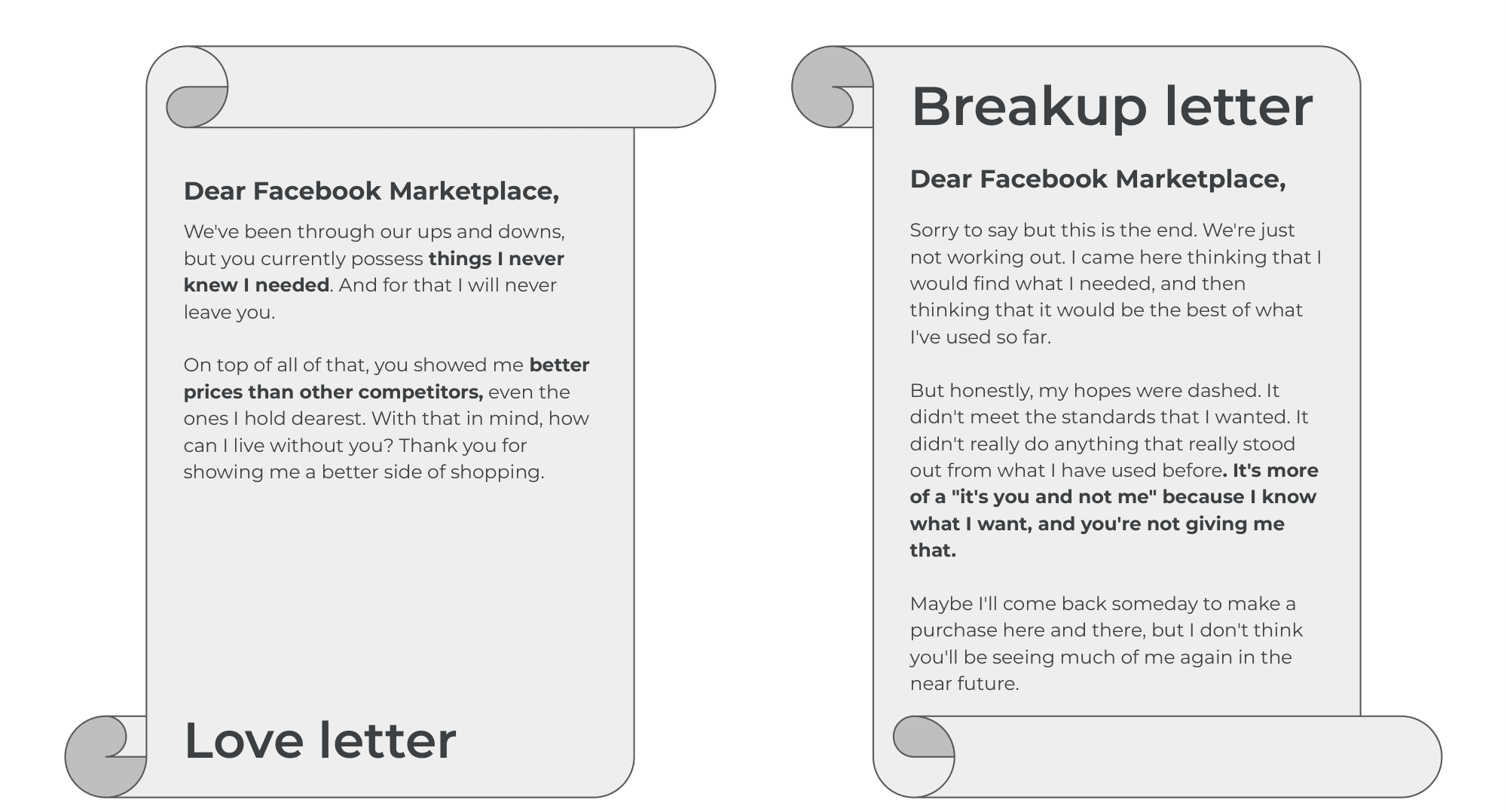

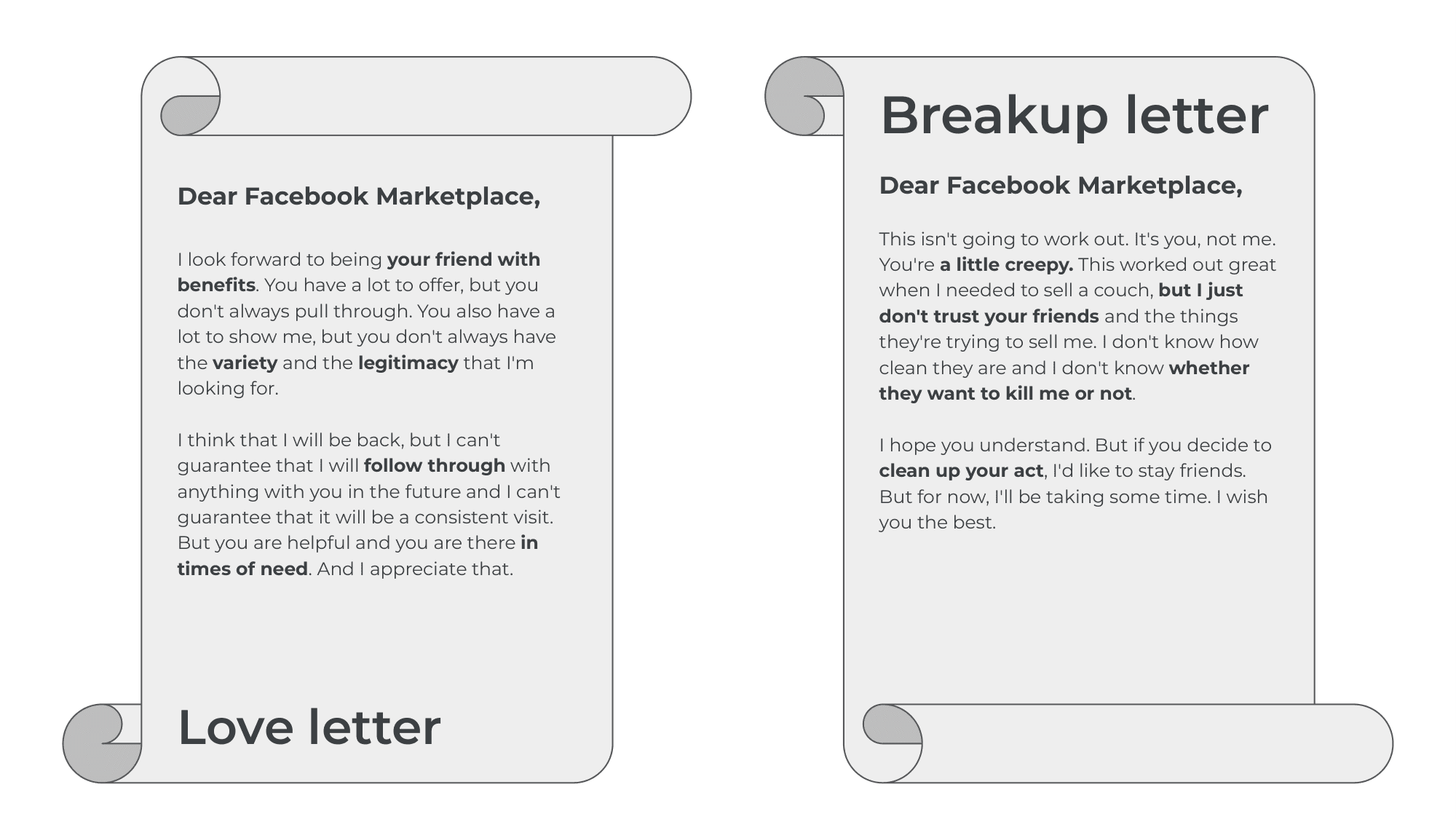

Love/Breakup Letters

Examples of love and breakup letters that participants wrote at the end of the study:

Recommendations

Short Term Opportunities

I structured recommendations into short- and long-term opportunities, prioritized based on user need, impact, and feasibility. The highest priority recommendations (near-term) were:

Support more filter controls (e.g., size, color, etc) to improve relevance of search results.

Visually distinguish between listings within user's location radius and listings outside of that radius. For listings outside of location radius, prioritize shippable listings and visually flag local-only listings.

Show shipping costs upfront on product card metadata.

Show new shoppers a diversity of item categories and conditions in the first few rows of Browse feed. Ensure some high quality pictures and new items are included.

Lean into value, variety, and browsing in value proposition messaging towards off-platform shoppers.

Long Term Opportunities

Long term, I encouraged the team to explore more fundamental product changes, such as:

Consider partnering with search teams to improve relevance of search results.

Explore ways to identify discrepant pricing between listing headers and descriptions.

Identify categories with gaps in supply relative to demand, and explore ways to increase supply (e.g., by suggesting to sellers that they sell those types of inventory).

Suggest to sellers that they provide higher quality photos and more informative descriptions in their listings (e.g., if they are not getting interest from shoppers).

Help sellers demonstrate trustworthiness by showing reviews, ratings, and length of time selling.

Clarify purchase protection policies upfront.

Impact

The research influenced decisions to start several initiatives related to:

Adding search filters (e.g., size for clothing and accessories)

Detecting misleading prices

Improving listing quality (e.g., photos and descriptions)

More broadly, the insights provided a timely snapshot of what it was really like to encounter Marketplace for the first time, with the many changes that had been made in the interface over time. For team members who had worked closely on the product for years, this fresh perspective helped build the empathy and "beginner's mind" necessary for effective strategic engagement with new shoppers.