Seller Shipping Experience Study

An in-depth interview study to explore why sellers chose to ship (or not ship) on Facebook Marketplace, as well as their needs and pain points in the shipping experience.

Context

Organization

Historically, Facebook Marketplace has been a platform for local commerce. However, in late 2018 and 2019 Marketplace launched shipping (i.e., enabling users to buy and sell items on Marketplace with shipping and on-site checkout). Shipping enabled products to have greater reach on the platform, while on-site check-out brought users into Facebook’s payment ecosystem and provided a direct selling fee to Facebook. The Facebook Marketplace Growth team wanted to increase the use of shipping on the platform, but the team had not yet talked with sellers to understand their experiences using shipping and what made sellers more (or less) likely to ship their products to buyers. The goal of this research was to uncover underlying motivations, needs, and challenges with shipping, to increase its use on the platform.

Goals

Business goal: Increase the use of shipping on Facebook Marketplace (i.e., more sellers offering shipping on more listings).

Research goals: Understand seller motivations and barriers to offering shipping on Marketplace, and needs and pain points throughout the shipping experience (from order placement to payment); identify improvement opportunities.

Team

My role: Lead researcher

Partners: Data scientist

Stakeholders: Product manager, designers, engineers, data scientist

Study Design

Method

To deeply understand the “why’s” behind sellers’ use (and non-use) of shipping, I needed to be able to probe deeply into sellers’ experiences with the product. In-depth interviews (conducted remotely, due to the onset of the COVID-19 pandemic) lent themselves well to these needs.

Sample

Thirteen Facebook Marketplace sellers who had shipped before on the platform, with a mix of sellers who 1) had used shipping multiple times and 2) had used shipping once, but not again. Sellers fell into a key user group called “Monetizers” - those whose primary motivation for selling was to earn income and sold regularly on a weekly basis.

Tools

Lookback, Google Suite

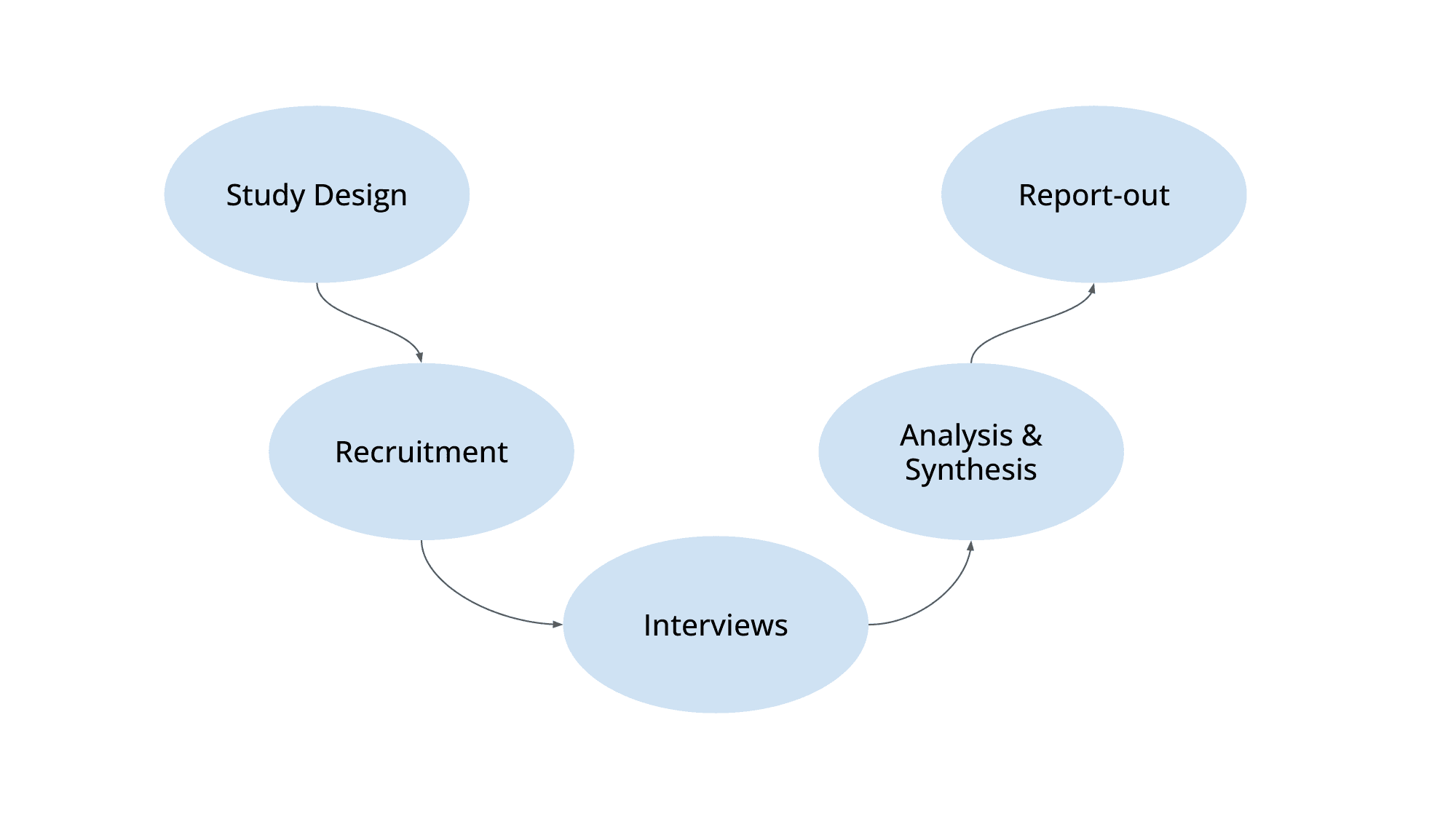

Process

Sampling

An important element of the study was talking to a mix of sellers who had offered shipping on Marketplace only once, but not again; and those who had shipped on Marketplace multiple times. This would allow us to get at 1) what stopped sellers from using shipping multiple times, and 2) what encouraged sellers to keep using shipping (i.e., both barriers and facilitators). I worked with my data science partner to identify sellers who fell into these respective groups based on their past on-platform shipping behavior.

Key Insights

Motivations & Barriers to Offering Shipping

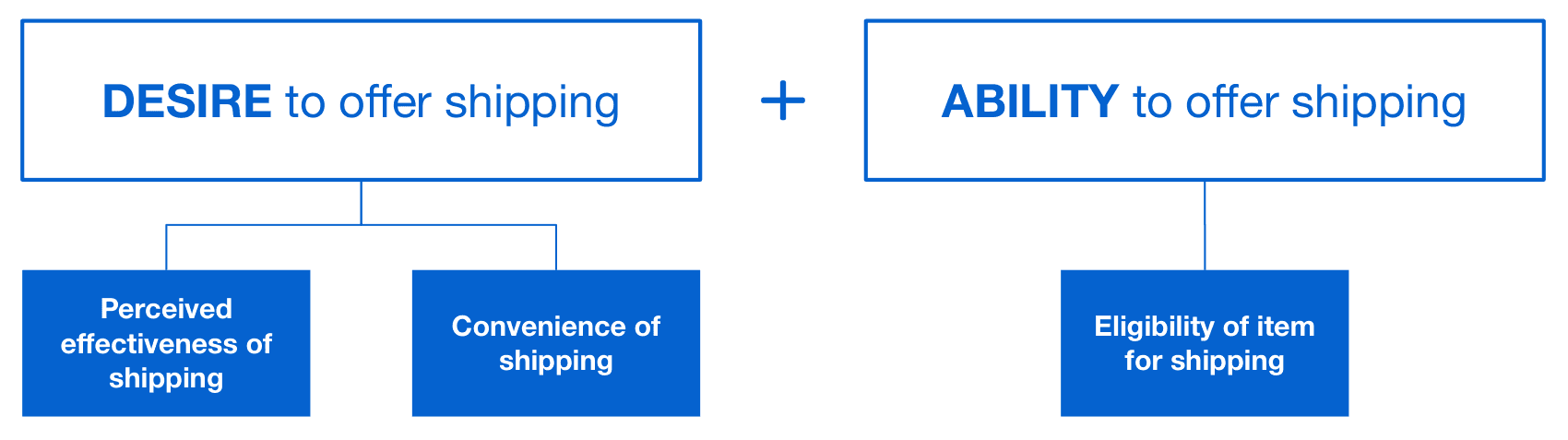

Sellers offered shipping when its effectiveness, convenience, and item eligibility aligned.

Sellers were generally excited about the introduction of on-platform shipping as a means of expanding their reach to more buyers, and thus increasing their chances of making a sale. However, they only offered shipping if 1) they thought it would attract buyers, 2) it was convenient, and 3) their item fell into one of the eligible categories for on-platform shipping.

"I love shipping… Best thing you guys ever added. Don’t take it away."

"It’s been really cool… Just given me a whole other audience of consumers that I otherwise wouldn’t have had."

Offering shipping was seen as effective only during free shipping promotions (i.e., when Facebook bore shipping costs).

Sellers were more willing to offer shipping during time-limited free shipping promotions, because buyers were more likely to order through shipping if they did not have to pay for shipping on top of the cost of the item. (This fits buyers' mental models of Marketplace as a place for local pick-up.) Conversely, sellers were less willing to offer shipping in the absence of free shipping promotions, because it was often difficult to find a buyer willing to pay for shipping and sellers rarely received buyer requests for shipping when there was no free shipping promotion.

"It was definitely helpful when Facebook was offering the free shipping for select items… That definitely motivated buyers to purchase with the free shipping incentive."

"So Facebook did the offer for the free shipping for items, so that was enticing, to list it with shipping. But now they don’t offer the free shipping… I believe I tried listing a few items for ship and no one bought them, so I kind of just stopped trying it."

Sellers viewed the convenience of shipping as relative to local pick-up and had differing opinions on which method was ultimately more convenient for them.

Some sellers viewed shipping as more convenient and lower hassle than local pick-up because it did not require coordinating with buyers to find a meeting time, nor did it have the problem of flaky buyers and no shows. It was a “guaranteed sale.” In addition, smaller items were easier and more convenient to ship (e.g., fitting into standard sized packages),

By contrast, other sellers viewed shipping as less convenient than local pick-up, due to the time investment in finding suitable packages, packaging items, going to the post office, and waiting to get paid. Large items (e.g., furniture) and oddly shaped items were difficult to pack and transport for shipping. "Porch pick-up" (i.e., having a buyer buy the item straight from their door) was less effort and provided “immediate gratification.”

"[It's] more on your time, when you want to ship it out. When you meet up with somebody, the schedules have to unite and work for both parties, and depending on people’s work schedules, that’s not always the easiest thing to do."

"You almost lose money, wasting all that time doing that… Five, ten minutes here, running an errand, getting stamps, spending 15 minutes in line at the post office, just adds up at the end of the day… Whereas I can take 15 minutes, meet with somebody on my front doorstep, and have my cash in hand."

Certain items were not eligible for shipping on Marketplace, preventing sellers from offering shipping (or leading them to ship off-platform).

Several sellers were unable to ship on platform because the item category was ineligible (e.g., Antiques and Collectibles). As a result, sellers were frustrated, and either did not offer shipping on those listings or shipped off platform (e.g., through PayPal Shipping) after finding a buyer on Marketplace.

"To be honest and frank with you, it’s because of Facebook limitations. That’s the straight-up truth. Because there’s only a select group of items that you’ve committed to ship on Marketplace… So that kind of limits things, depending on what I’m selling."

Seller Needs & Pain Points in the Shipping Experience

Efficiency, transparency, and trust were core seller needs (and pain points) in the shipping experience.

While sellers had additional needs like convenience and flexibility, they were secondary to the table-stakes needs above.

Sellers struggled with slow payout speeds for shipped orders, making it a less efficient way to get paid compared to the immediacy of local pick-up.

The payment timeframe for shipped orders was too long, often taking weeks to get paid. In fact, sellers often did not know if ever got paid. This contradicted their entire goal of selling (i.e., to earn money) and directly contrasted with the immediacy of payment during local pick-up. Sellers expected funds to be available in their bank account within a few days of delivery at most. The problem was exacerbated by poor status indicators and unclear payment policies (see below). All of this made sellers more frustrated and less confident with shipping on Marketplace.

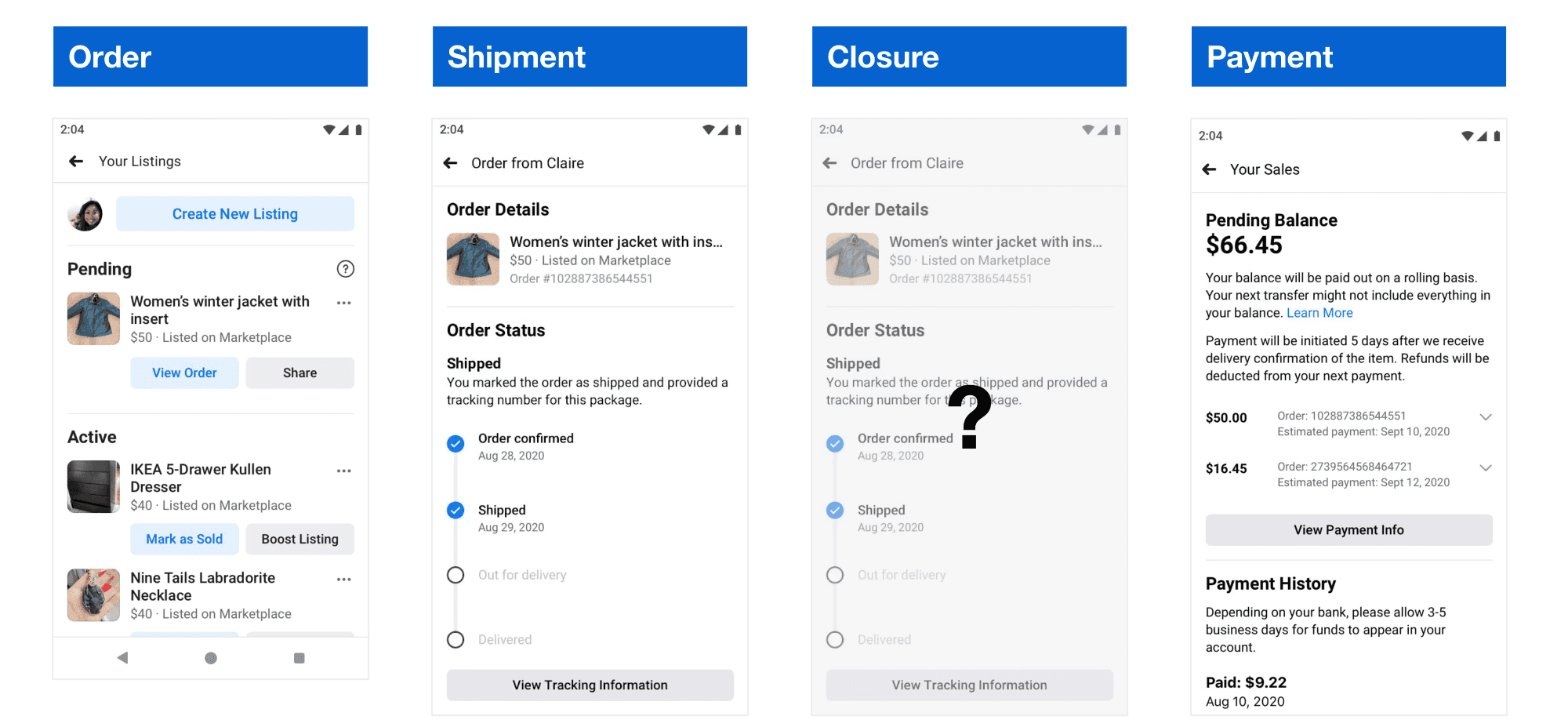

Unclear and missing status indicators caused frustration throughout the various stages of the shipping process.

Throughout the shipping process, key status indicators were often unclear, hidden, or missing entirely. This caused anxiety, confusion, and frustration; forced sellers to repeatedly and manually check their listings and balance (taking precious time away from their families and full-time jobs); caused delays; and even led to mistakes (e.g., marking Pending listings as sold).

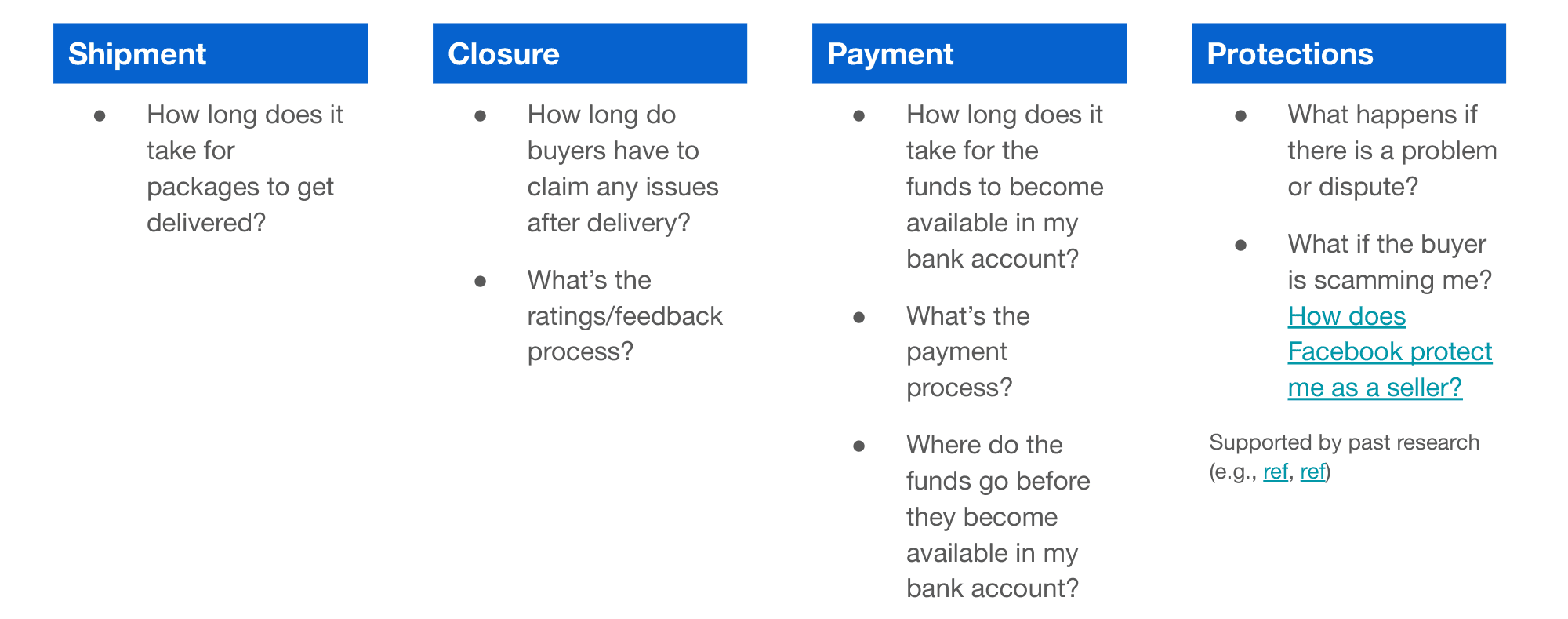

Each phase of the shipping process (order placement, shipment status, order closure, and payment) had key seller questions associated with it. Not being able to answer these questions led to negative impacts for not only sellers, but at times buyers as well.

"You should really notify the seller along the way… I would like to know that the package was delivered - it would be great to receive some kind of notification about that. It would be great to be prompted to leave some kind of feedback, or that feedback’s been left for me."

Sellers also lacked a clear understanding of Marketplace’s shipping process, policies, and timeline, exacerbating frustration, confusion, and anxiety.

Sellers did not understand how shipping worked on Marketplace, and had critical unanswered questions throughout the process.

"There’s no timelines that I’m aware of: how long does the buyer have to accept the item, or say that they’re good with the item, or say that they want to return the item, or that there’s an issue with the item… I don’t even know what the terms are for when I get my money."

There was confusion and anxiety over whether Facebook would protect sellers in case of scams.

Sellers were concerned about the risk of scammers and the lack of seller protections. Some sellers were unsure whether Facebook protected sellers in disputes with buyers or not. Lack of clear seller protections increased anxiety and reduced confidence about shipping on Marketplace, and prompted sellers to wait in line at the post office to drop off their packages (in order to have certainty and proof that their item shipped).

"The Marketplace platform, it doesn’t seem so protected… When I use Poshmark, eBay, or Mercari, I just feel like there’s more layers of safety… I just always wonder, what if the person says they never got it? What happens? Or it’s damaged? Who’s responsible? Who pays? How does that work? Who defines on what end there’s an error - on the shipper end or the buyer end?"

Shipping in the Broader Context of Selling

Critically, sellers saw shipping as a supplement, NOT a replacement, to local pick-up.

Their primary goal was to sell, and their primary mental model for Marketplace was as a place for local pick-up. As a result, when they offered shipping, they offered local pick-up, too. Ultimately, fulfillment method was up to the buyer.

"I want to [ship more], but I let my customer decide."

"If someone wants to meet me locally, I actually offer them the shipping option every time… They always refuse; they want to save a few bucks and come drive and pick it up."

Bigger problems were low listing visibility and unresolved listing bans.

Fulfillment method (e.g., offering shipping) was one way to increase reach. But it did not address other issues like low listing visibility (i.e., not getting enough demand for items) or listings being flagged and banned. These issues were top-of-mind to sellers and a source of anxiety, confusion, and frustration.

"I’ve noticed that I could list an item, and depending on the circumstance, it sometimes gets lots of views as I feel it should, and then there’s other times those views just sit on zero, and I feel like the system is somehow ghosting or blocking my listing and not letting it be seen."

Recommendations

At a high level, my recommendations to the team were to:

Emphasize selling effectiveness and buyer reach as the primary value props of shipping

Shorten payment speeds, provide clear status indicators, clarify how shipping works, and offer seller protections.

Help sellers to sell more effectively overall, regardless of fulfillment method.

I also offered more granular recommendations related to increasing motivation to offer shipping and addressing pain points in the experience.

I outlined all of the recommendations in a spreadsheet, which I then shared with my cross-functional partners (PM, design, engineering). I asked each partner to prioritize the recommendations based on their focus area. This led to a collective prioritization based on user impact, design opportunity, business viability, and technical feasibility. We then identified those recommendations that were highest priority across disciplines as a starting point for future work.

Impact

Shaped marketing content related to the value propositions of shipping.

Led to clearer status indicators in the UI.

Kicked off an initiative to provide Help Center content related to shipping process and timelines.

Prompted critical data science investigation that confirmed that sellers who offered shipping typically also offered local pick-up on listings. This led to an important reframing of the issue as buyer-driven, not just seller-driven.

Built empathy with sellers' core underlying goals (i.e., make a sale, support themselves and their families).